Explore Mathematics

Mathematicians use mathematical theory, computational techniques, algorithms, and the latest computer technology to solve economic, scientific, engineering, physics, and business problems. There is a wide variety of activities and careers that math majors pursue. However, mathematical work itself is largely theoretical or applied.

Theoretical mathematicians advance mathematical knowledge by developing new principles and recognizing previously unknown relationships between existing principles of mathematics. Although these professionals seek to increase basic knowledge without necessarily considering its practical use, such pure and abstract knowledge has been instrumental in producing or furthering many scientific and engineering achievements. Many theoretical mathematicians are employed as university faculty, dividing their time between teaching and conducting research.

Applied mathematicians use theories and techniques to formulate and solve practical problems in business, government, engineering, and in the physical, life, and social sciences. For example, they may analyze the most efficient way to schedule airline routes between cities, the effects and safety of new drugs, the aerodynamic characteristics of an experimental automobile, or the cost effectiveness of alternative manufacturing processes. Applied mathematicians working in industrial research and development may develop or enhance mathematical methods when solving a difficult problem. Some mathematicians, called cryptanalysts, analyze and decipher encryption systems designed to transmit military, political, financial, or law enforcement related information in code.

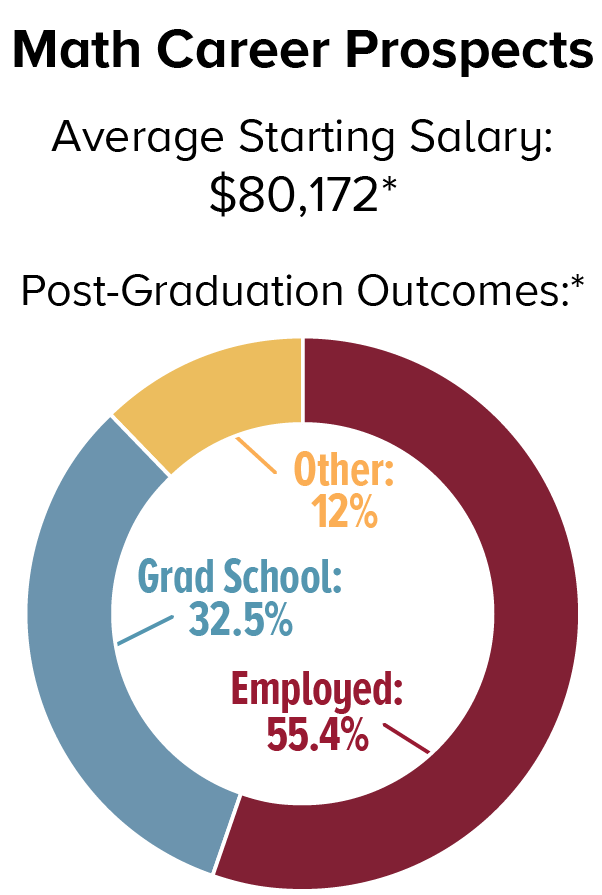

*Salary and Career Outcomes gathered from the 2020-2021 CSE Graduation Survey. Post-graduation outcomes reflect the percentage of students who were employed full-time in their field or were enrolled in a graduate program at 6 months post-graduation.

+

What can I do with a major in Mathematics?

INDUSTRIES

- Agriculture

- Banking

- Biostatistics

- Business

- Clinical trials

- Computer information

- Consulting

- Ecology/environmental research

- Education

- Financial services

- Government

- Insurance

- Management

- Manufacturing

- Pharmaceuticals

- Product reliability

- Public health

- Research

- Sports

- Statistics

- Technology

EMPLOYERS

- Allianz Life

- Allstate Insurance

- Ameriprise Financial

- Cognizant Technology Solutions

- Deloitte

- Epic Systems

- Fast Enterprises, LLC

- IBM

- Meditech

- Microsoft Corporation

- Northwestern Mutual

- PricewaterhouseCoopers

- Securian Financial Group

- Target Corporation

- The Travelers Companies, Inc

- Towers Watson

- US Bank

- UnitedHealth Group/Optum

- Wells Fargo

TECHNICAL SKILLS

- Microsoft Excel

- Mathematica

- MATLAB

- Microsoft Office

POSSIBLE POSITIONS

- Actuary: Deals with the financial impact of risk and uncertainty. Actuaries mathematically evaluate the likelihood of events and quantify the contingent outcomes in order to minimize losses.

- Auditor: Examine and analyze accounting records to determine financial status of establishment and prepare financial reports concerning operating procedures.

- Database administrator: Works with database software to develop/implement ways to manage and store data.

- Economist: Studies how society distributes resources to produce goods and services. Economists conduct research to develop forecasts on a wide variety of issues, including energy costs, inflation, interest rates, exchange rates, business cycles, taxes, employment levels, and more.

- Financial analyst: Provides guidance to businesses and individuals making investment decisions and assess the performance of stocks, bonds, commodities, and other types of investments.

- Insurance underwriter: Decides whether insurance is provided and, if so, under what terms. Insurance underwriters identify and calculate the risk of loss from policyholders, establish who receives a policy, determine the appropriate premium, and write policies that cover this risk.

- Market/survey researcher: Gathers information and statistical data to help companies understand what types of products people want, who will buy them, and at what price.

- Mathematician: Uses mathematical theory, computational techniques, algorithms, and the latest computer technology to solve economic, scientific, engineering, and business problems.

- Operations research analyst: Helps managers make better decisions and solve problems by applying mathematical modeling methods to develop, interpret, and implement information.

- Personal financial advisor: Manages and assesses the financial needs of individuals and assists them with investments, tax laws, and insurance decisions.

- Statistician: Applies mathematical and statistical knowledge to the design of surveys and experiments.

- Supply chain analyst: Apply quantitative skills to answer critical strategic business questions and support operational initiatives. Translate high-level business problems into more specific questions which can be answered by data driven analysis.

**Some of these positions may require an advanced degree.

GET INVOLVED

- Active Energy Club

- Actuary Club

- Association for Women in Mathematics

- CSE K-12 Outreach

- CSE Ambassadors

- CSE International Ambassadors

- Engineers Without Borders

- National Society of Black Engineers

- Plumb Bob Honorary Leadership Society

- Science and Engineering Student Board

- Society for Industrial and Applied Mathematics

- Society of Asian Scientists and Engineers

- Society of Hispanic Professional Engineers

- Society of Women Engineers

- Solar Vehicle Project

- Tau Beta Pi

- TeslaWorks

- Theta Tau

RESOURCES

+

Q&A with Justin Larson, Actuarial Consultant, Aon

What do you do?

I consult with a wide array of clients, with a focus towards their retirement programs. My main goal is to determine solutions to help clients manage pension plans to meet financial needs, as well as enable them to serve as a resource for employee benefits and retention. I am also a “People Leader” in the Retirement and Investment department in Minneapolis and manage a group of six colleagues. I am deeply involved with learning and development projects both within our organization and also with the Society of Actuaries and the University of Minnesota.

What's a typical work day?

Each day is different. As a consultant, you never know what to expect—as your main purpose is to serve your clients in the best way possible. Some days involve attending meetings to present new solutions to clients. Other days involve building internal teams, which has been one of my primary focus over the past several years.

What qualities are important for this position?

As consultant, you need to have great people skills in addition to the technical skills that we learn through experience and exams. I feel like a lot of incoming candidates do not realize the importance of the soft skills that are needed in today’s business world. A successful consultant is always willing to meet new people and develop relationships. Networking is always important in any role you will serve.

What about technical skills?

You need to be very strong in math and finance, and you need to have a desire and willingness to continually learn. Being able to see both the big picture as well as focusing on details is also very important. A lot of the contacts we serve are top-level or c-suite executives—such as the chief executive officer, chief operating officer, or chief information officer—and they need to hear your recommendation in a few sentences. Being able to boil down hours of work into concise summaries is a skill that should not be overlooked.

What training were you offered for your position?

Starting out, a lot of the training is informal and development is primarily through hands-on experience and walking through projects with more senior colleagues. Actuaries continually learn. There is never a stopping point in the learning process. Even after all of the exams are completed, we have department training sessions and continuing education requirements, which everyone must adhere to.

What part of your job is most satisfying?

Consulting is unique in that you get the face-to-face interaction with clients and can see just how you are making an impact with the work that you do. That is the most satisfying part of my job.

Most challenging?

There is almost never a right or wrong answer when developing solutions for clients. The primary focus is to put yourself in their shoes and try to understand how they view their problems. This can be very challenging since we all see things from a different perspective.

What are your possible career paths now?

The beauty of my current position is that you are truly at the steering wheel for where you would like to go. It’s all about the time, effort, and willingness to continue to grow to determine where you end up. For me, this involves being more involved with leadership and people development.

Advice for current students?

While focusing on GPA and coursework is very important, realize that a lot of the skills you will acquire for your career will not be developed until you are exposed to hands-on experience. I know of many students who excelled in school by being very “book smart” but struggled as they were not able to apply their knowledge to real-world applications.

Any other advice you'd like to share?

I cannot stress it enough, but to be successful in a consultant role, you must have soft skills. Networking is a great way to develop these skills, and it’s never too early to start.

+

Q&A with Elyssa-Anne Mullings, Operations Data Analyst, Target Corp.

What do you do?

Manage, analyze, and report on all data for Target’s own food brand products.

What’s a typical work day?

Morning data refresh to update reports, meetings with cross-functional teams to have insight into all aspects of food design process and identify data that needs to be tracked/recorded, data visualization/automation for process improvement, respond to ad-hoc report requests throughout the day.

What qualities are important for this position?

Interest in problem solving, attention to detail, self-starter, interest in storytelling with data, interest in both independent and team work.

What about technical skills?

Data analysis/management/visualization; programming (VBA, SQL)

What training were you offered for your position?

General onboarding or new hire training. Prior to Target, I was a data analytics consultant so I came into my current role with some industry experience.

What part of your job is most satisfying?

I get to solve business problems with data and communicate my findings to leaders.

Most challenging?

Navigating business relationships or hierarchy can be challenging, especially when it comes to final decision making.

What are your possible career paths now?

I'm pursuing an M.S. in data science and once I finish I’d like to work as a senior data scientist for a few years, then manage a team of data scientists. The field of data science is constantly evolving. So, I’m also looking forward to new opportunities and career paths that will arise.

Advice for current students?

Definitely push through. It won't be easy. At times you'll question why or how you got yourself into this, but it is worth it. Identify an end game early in your undergraduate career—whether that be graduate school, your ideal job post-graduation, etc.—and work towards that goal every day.

Any other advice you'd like to share?

Pursue internships.