MCFAM programs stay on trend

MFM Program Redesign:

After seeking input from instructors, alumni and current students, MCFAM redesigned the MFM program and launched it in fall of 2021. Katherine Kovarik, MCFAM Assistant Professor said “we were able to enhance it, by bringing it up to date, integrating the curriculum more closely, and making it more flexible.”

The improvements incorporate a variety of new elements. One is the addition of three modeling courses that employ math and programming all in the context of financial applications and problems, rather than just coding courses on their own. A machine learning and data science for finance course was also added to make sure students are prepared for the explosion of Fintech applications growing across the globe today. More statistics in the coursework was added because the discipline is critical to quantitative finance. In addition to the core courses, a selection of electives is available to students every academic year so they can dig deeper into their areas of interest. Instructors and current students are thrilled with the changes and alumni wish they had these courses when they were going through the MFM.

MFM Individual Courses available this fall:

Starting in fall 2022, practitioners can take single courses or a course series. They must get approval from the MFM program. To do that just email us at mcfam@umn.edu. To see more detail on the courses, click on this link.

New, applied module in Actuarial Mathematics Course

A 4-session module was introduced to the Actuarial Mathematics course this spring to help students learn an industry application of data analytics. Practitioners from Optum created and led the sessions. Students learned to use R, a statistical computing and graphics programming language; and they worked with real datasets to create a healthcare data analytics project. Breanne Richins, the course instructor said “the students were thrilled to get hands-on experience directly from people in the field. The Optum practitioners were very happy to be involved. This is the perfect type of project for our students who want a leg up when they are competing for jobs that require this real world experience.”

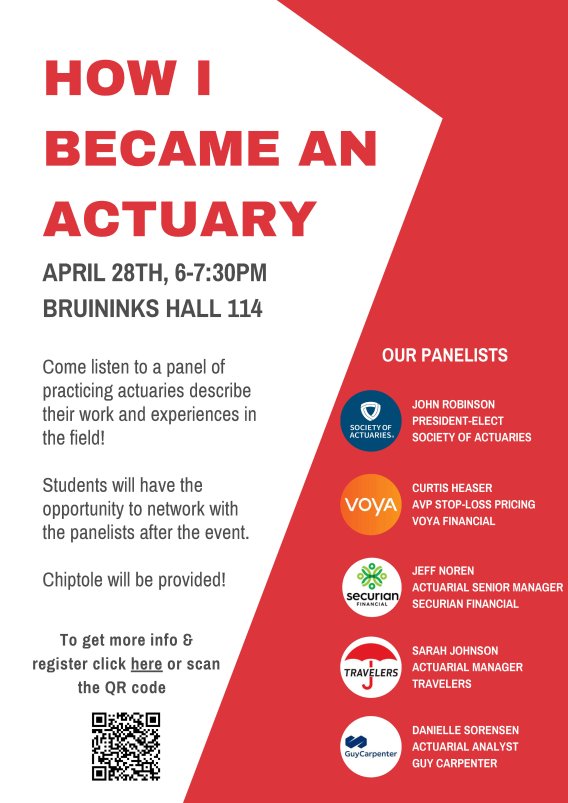

Spring “How I Became an Actuary” Panel

Seventy four people attended the “How I Became an Actuary” panel on the evening of April 28th. Actuary Club and U of MN’s Gamma Iota Sigma Chapter (GIS –the US insurance industry’s largest collegiate talent pipeline organization) came together to host the panel of experts from a broad cross section of actuarial practice areas. An executive from life insurance firm, Voya Financial, a manger and an analyst from Travelers property casualty firm and reinsurance firm, Guy Carpenter were all in attendance. John Robinson, President-Elect of the Society of Actuaries (SOA) provided insight on the upcoming year of SOA priorities.

The panelists were also of the opinion that too much emphasis is put on passing exams and not enough on the other skills, qualifications, and practice area knowledge that make great actuaries. John Robinson, indicated the SOA is concerned that the exam process is causing qualified candidates who would have had the ability to pass exams to pursue other careers. They are currently looking at ways to adjust the process.

GIS President, Elsa Dahlman was pleased with the overall success of the event. “I have already had students ask me when the next event is. The panelists had exciting experiences and perspectives to share, and Jack Hillesheim, President of Actuary Club, did a great job moderating!”