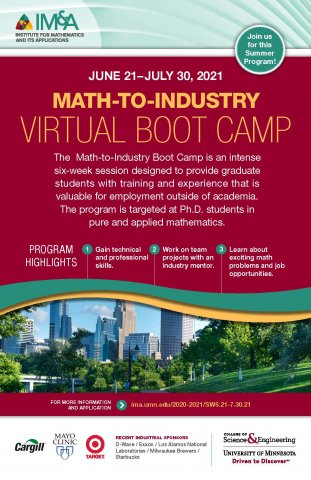

Math-to-Industry Boot Camp VI

Advisory: Application deadline is March 7, 2021

Organizers:

- Thomas Hoft, University of St. Thomas

- Daniel Spirn, University of Minnesota, Twin Cities

The Math-to-Industry Boot Camp is an intense six-week session designed to provide graduate students with training and experience that is valuable for employment outside of academia. The program is targeted at Ph.D. students in pure and applied mathematics. The boot camp consists of courses in the basics of programming, data analysis, and mathematical modeling. Students work in teams on projects and are provided with training in resume and interview preparation as well as teamwork.

There are two group projects during the session: a small-scale project designed to introduce the concept of solving open-ended problems and working in teams, and a "capstone project" that is posed by industrial scientists. Recent industrial sponsors included D-Wave Systems, Exxonmobil, Los Alamos National Laboratories, Milwaukee Brewers, Starbucks.

Weekly seminars by speakers from many industry sectors provide the students with opportunities to learn about a variety of possible future careers.

Eligibility

Applicants must be current graduate students in a Ph.D. program at a U.S. institution during the period of the boot camp.

Logistics

The program will take place online. Students will receive a $800 stipend.

Applications

To apply, please supply the following materials through the link at the top of the page:

- Statement of reason for participation, career goals, and relevant experience

- Unofficial transcript, evidence of good standing, and have full-time status

- Letter of support from advisor, director of graduate studies, or department chair

Selection criteria will be based on background and statement of interest, as well as geographic and institutional diversity. Women and minorities are especially encouraged to apply. Selected participants will be contacted in April.

Participants

| Name | Department | Affiliation |

|---|---|---|

| Douglas Armstrong | Department of Data Science | Securian Financial |

| Yuchen Cao | Department of Mathematics | University of Central Florida |

| Samara Chamoun | Department of Mathematics | Michigan State University |

| Ana Chavez Caliz | Department of Mathematics | Pennsylvania State University |

| Alexander Estes | Institute for Mathematics and its Applications | University of Minnesota, Twin Cities |

| Raymond Friend Jr | Department of Mathematics | Pennsylvania State University |

| Ghodsieh Ghanbari | Department of Mathematics and Statistics | Mississippi State University |

| Marc Haerkoenen | School of Mathematics | Georgia Institute of Technology |

| Tony Haines | Department of Computational and Applied Mathematics | Old Dominion University |

| Natalie Heer | CH Robinson | |

| Thomas Hoft | Department of Mathematics | University of St. Thomas |

| Alicia Johnson | Department of Mathematics, Statistics, and Computer Science | Macalester College |

| Malick Kebe | Department of Mathematics | Howard University (Washington, DC, US) |

| Juergen Kritschgau | Department of Mathematics | Iowa State University |

| Marshall Lagani | Department of Data Science | Securian Financial |

| Kevin Leder | Department of Industrial System and Engineering | University of Minnesota, Twin Cities |

| Ivan Marin | Cargill, Inc. | |

| Francisco Martinez Figueroa | Department of Mathematics | The Ohio State University |

| Avishek Mukherjee | Department of Mathematical Sciences | University of Delaware (Newark, DE, US) |

| Muharrem Otus | Department of Mathematics | University of Pittsburgh |

| Smita Praharaj | Department of Mathematics | University of Missouri |

| Tanmay Raj | Cargill, Inc. | |

| Abba Ramadan | Department of Applied Mathematics | University of Kansas |

| Samanwita Samal | Department of Mathematics | Indiana University |

| Natalie Sheils | UnitedHealth Group | |

| Blerta Shtylla | Pfizer | |

| David Shuman | Department of Mathematics, Statistics and Computer Science | Macalester College |

| Lauren Snider | Department of Mathematics | Texas A & M University |

| Daniel Spirn | University of Minnesota | University of Minnesota, Twin Cities |

| Elizabeth Sprangel | Department of Mathematics | Iowa State University |

| Kaisa Taipale | Contractual Pricing Group | CH Robinson |

| Sijie Tang | Department of Mathematics | University of Wyoming |

| Cameron Thieme | Department of Mathematics | University of Minnesota, Twin Cities |

| Shuxian Xu | Department of Mathematics | University of Pittsburgh |

| Lei Yang | Department of Mathematics | Northeastern University |

| Grace Zhang | School of Mathematics | University of Minnesota, Twin Cities |

| Miao Zhang | Department of Mathematics | Louisiana State University |

| Jennifer Zhu | Department of Mathematics | Texas A & M University |

| Ahmed Zytoon | Department of Mathematics | University of Pittsburgh |

Projects and teams

Team 1 — Cargill: Hydrologic Energy Generation Optimization

- Mentor Ivan Marin, Cargill Corporation

- Mentor Tanmay Raj, Cargill Corporation

- Ana Chavez Caliz, Pennsylvania State University

- Francisco Martinez Figueroa, Ohio State University

- Juergen Kritschgau, Iowa State University

- Avishek Mukherjee, University of Delaware

- Smita Praharaj, University of Missouri

- Cameron Thieme, University of Minnesota

- Jennifer Zhu, Texas A & M University

The increased penetration of variable renewable energy (VRE) and phase-out of nuclear and other conventional electricity generation sources will require an additional flexibility in the power grid and a demand to lower the gap between the generation and demand, and how this can influence the energy pricing in the short and long term. Clean water is essential for hydropower generation, and the main source of electrical power generation in Brazil. Due to the limited water resources and the variability of precipitation, there is a need to investigate an optimal management of these resources in order to meet the power grid demand, and predict the power generation capacity, given the historical rain patterns, reservoir water levels and energy demands.

Team 2 — Securian Financial: Predicting Group Life Client Mortality During a Pandemic

- Mentor Douglas Armstrong, Securian Financial

- Yuchen Cao, University of Central Florida

- Samara Chamoun, Michigan State University

- Marc Haerkoenen, Georgia Institute of Technology

- Abba Ramadan, University of Kansas

- Lei Yang, Northeastern University

- Shuxian Xu, University of Pittsburgh

During a pandemic the ability to predict risk for clients becomes paramount to manage risk effectively. The impact that a pandemic has may differ depending on the demographics and regional considerations for each client. This brings in additional complexity to the analysis and forecasting of future risk a client may pose. In this project, students will enrich a simulated client dataset with publicly available data before developing a machine-learning based approach to predict adverse risk of multiple clients.

Team 3 — CH Robinson: Impact of Weather and Agricultural Events on Truckload Cost Per Mile

- Mentor Kaisa Taipale, CH Robinson

- Raymond Friend Jr, Pennsylvania State University

- Ghodsieh Ghanbari, Mississippi State University

- Tony Haines, Old Dominion University

- Malick Kebe, Howard University

- Elizabeth Sprangel, Iowa State University

- Grace Zhang, University of Minnesota

Fresh fruits and vegetables are an important group of commodities in the US commonly transported by truck from fields in predominantly southern growing regions across the US (for instance, from California to the Northeast). While irrigation dampens the effect of rainfall crop yields, temperature and rainfall are still important factors in the timing of fresh fruit and vegetable harvest and thus transport. This work will examine the magnitude of impact of vegetable harvest timing on transportation costs, using external inputs like temperature and rainfall as well as variables intrinsic to the truckload market. Challenges include combining the geographic characteristics of the time series involved: univariate time series methods provide some benefit but stronger results come from exploiting geography and freight characteristics. Bayesian models and causal impact analysis are natural tools for this application.

Team 4 — CH Robinson: CH Robinson Volume Simulation

- Mentor Natalie Heer, CH Robinson

- Mentor Bethany Stai, CH Robinson

- Mentor Michael Chmutov, CH Robinson

- Mentor Kaisa Taipale, CH Robinson

- Muharrem Otus, University of Pittsburgh

- Samanwita Samal, Indiana University

- Lauren Snider, Texas A & M University

- Sijie Tang, University of Wyoming

- Miao Zhang, Louisiana State University

- Ahmed Zytoon, University of Pittsburgh

In Economics there is classically an inverse relationship between the price of an item and the quantity of the item that customers will choose to purchase. If prices increase, customers will purchase fewer items, and if prices decrease customers will choose to purchase more items. If companies can predict the volume change associated with a change in price, they can optimize their pricing strategy for overall profitability max(Unit Price * Volume). The goal of this project is to help CHR be smarter in optimizing our business strategy.